Part 1: Halving, ETFs, Macro

Annotation

The alternative title of this article: "Cryptocurrency Influences Macroeconomics."

This headline is striking and may deter readers because we are used to thinking the opposite: that external market perturbations and speculations influence the blockchain technology sphere. We move from discussions about Federal Reserve rate decisions to topics about who adopted the latest ETF for which cryptocurrency

Remembering the times when cryptocurrencies were mocked and not taken seriously, we did not notice how they became a bargaining chip in one of the most important political events of modern times - the US presidential race.

We are not here to prove this thesis, but if you look through the loud headlines, you can see the reality. BlackRock, whose activities in the crypto sphere we noted two years ago, has triggered a paradigm shift in the perception of the cryptocurrency market:

BlackRock's iShares Bitcoin Trust (IBIT) reached $10 billion in assets under management in just seven weeks, which took more than two years for the first gold ETF in the US.

The gold ETF, as shown by historical analysis, increased capitalization 13 times since its launch.

Larry Fink, CEO of BlackRock, stated that cryptocurrency significantly replaces gold as a means of hedging and preserving value.

Daily trading volumes of Bitcoin ETFs significantly exceed those of gold funds, confirming their rapid adoption and growing popularity among institutional investors.

The 2024 US presidential elections underscore the growing influence of cryptocurrencies on the political landscape. Pro-cryptocurrency candidates such as Donald Trump and Ron DeSantis actively use cryptocurrencies in their campaigns, presenting them as symbols of innovation and personal freedom. Approximately 20% of voters own cryptocurrencies and consider candidates' positions on cryptocurrencies when voting.

The purpose of this article is to conduct a concise retrospective of previous causes to look at the future directions of the crypto market. Those are already beginning to change the modern order.

In other words, we aim to fill the vision and prepare for the new reality being formed by the decentralization movement.

We are used to focusing on Bitcoin Halving as a significant event accompanied by a cycle change, predicting the growth of crypto adoption and their quotes.

History has repeatedly given us examples of self-fulfilling prophecies. In the 16th century, the principle of animal magnetism was used to treat diseases and induce transcendental states with the help of protruding iron pipes from a bath.

We propose to delve deeper and pay attention to the directions of the crypto market and projects that have every chance of becoming leaders of the bull cycle and promoters of decentralization ideas. The projects mentioned below are already transforming the conventional perception of web3:

Decentralized applications have gained the ability to attract users through classic methods - email, phone, Apple/Google ID, etc.

The concept of "different blockchains and networks" is gradually disappearing, moving into the phase of "one unified network", where users do not need to know what's under the hood.

Projects in the NFT sphere are already competing with giants like Disney on their home turf - in the real world.

Tens of millions of users in Web3 in a few months - this is the new reality.

Cryptocurrencies now have "fundamental" tasks they solve, such as decentralized artificial intelligence.

This article can be useful both for a beginner looking for their first earnings in the unknown world of blockchain and for an experienced founder who may find ideas and inspiration for the evolution of their own product.

The recommendation for interpreting this and our other works is extremely simple: recalling the analogy with Oxford examination tasks, where one needs to find the maximum number of uses for a simple brick or paperclip - the one who finds more gets an advantage.

An inquisitive mind finds answers and achieves more in this dynamic world.

We have tried to ensure that the article you read finds a place in the foundation of your understanding of the future of digital finance, linking diverse but important segments of the crypto market in one place to see the whole picture.

After all, beauty is in the eye of the beholder.

To uncover a profound topic, one must resonate with reality, so we invited leaders from various industry segments to expand the vision of the article.

Founders and top managers from projects such as Berachain, Redacted, Pudgy Penguins, Sofamon, TON Foundation, Synonym Finance, Infrared, Argent participated in its writing.

1.1 Ups and downs

Taking a look at the charts of crypto price growth, we can see that it resembles a roller coaster ride. The ups and downs are swiftly succeeding each other. These fluctuations are the result of bull and bear markets that intertwine, creating unique opportunities for investors and traders.

We've previously covered how to survive a bear market and why this is the best time for cryptocurrencies. Now we want to dive back into the crypto story, but look at it from a different angle. We will look at it through the eyes of a bull.

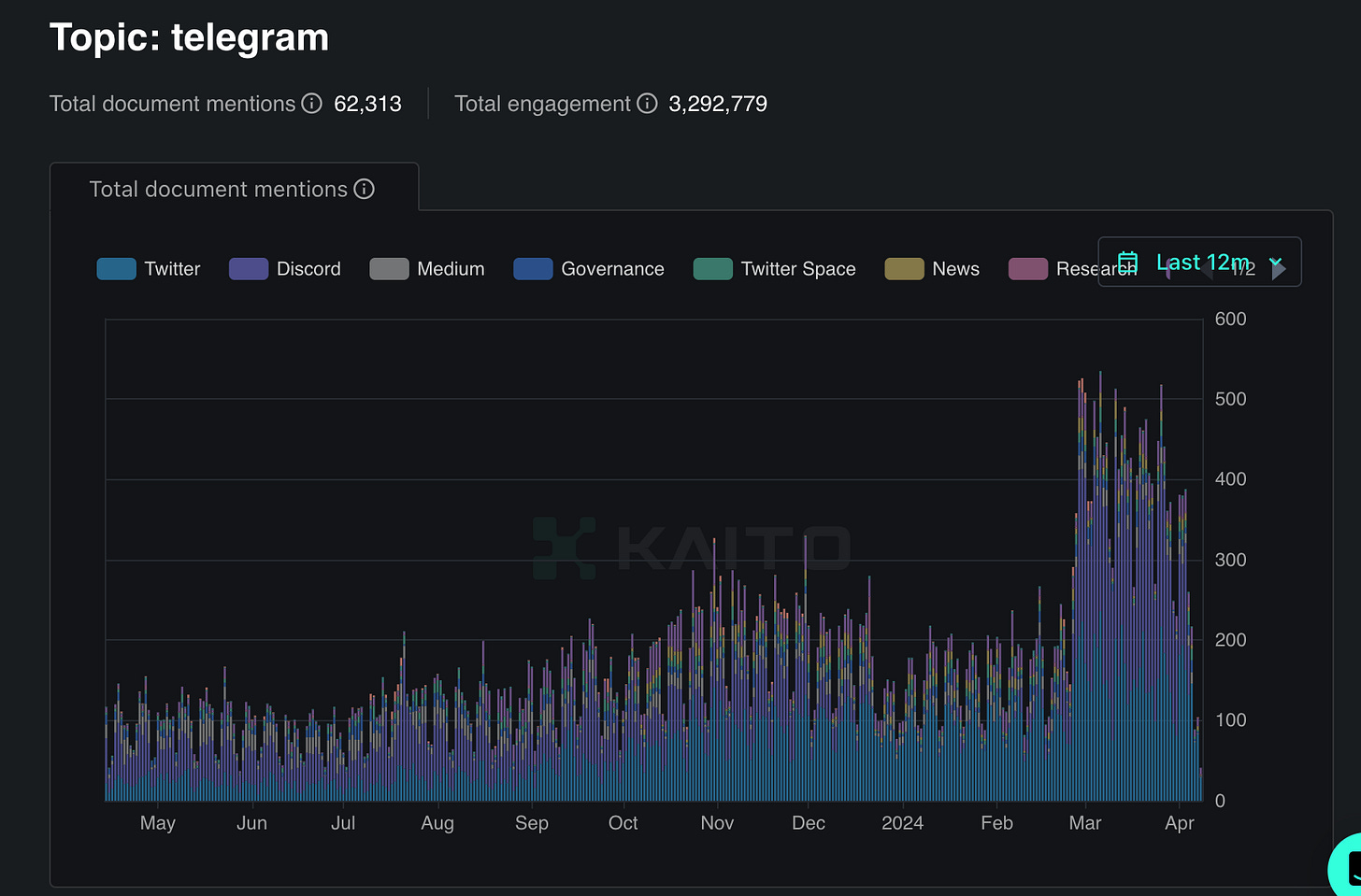

This article was written with the help of our partner Kaito.AI

Our research partner is Kaito.AI, a platform that is taking research and analytics on Web3 to the next level through the use of artificial intelligence.

Our plans for this partnership are very ambitious: the Kaito platform will be integrated into all of our products. Together with Kaito's analytics team, we are committed to publicly showcasing new research standards and continuing to advance the field.

Bull market is a period of asset price growth, when optimism and confidence in the future prevail over pessimism. It is a time when investors believe in the successful development of the market and are willing to take risks to get high returns. Bull market is invariably associated with the influx of fresh blood flowing into the market and the growing popularity of cryptocurrencies in society.

Throughout the historical development of cryptocurrencies, we have witnessed several bull cycles. Each of these cycles had its own unique features and was characterized by certain reasons for growth.

These cycles usually occur in different time periods and involve different factors that affect the price of cryptocurrencies. Some of these factors may be related to overall economic health, technological innovation, or regulatory changes.

In any case, studying these cycles can help us better understand the dynamics of the cryptocurrency market and possibly predict its future development.

It is worth noting that Bull cycles are characterized not only by the inflow of new blood into the market. But also by the launches of a large number of new projects.

During the bear market in cryptocurrency space, many projects struggled to attract investments. However, some teams not only survived but also secured significant funding. During this period, investors were more cautious and chose projects that showed the greatest potential for long-term growth and innovation.

One such example is the Chainlink project, which managed to attract investments and become one of the key players in the field of decentralized oracles. Amid the overall market downturn, Chainlink was able to prove its importance and potential, which drew the attention of major investors.

Another example is Polkadot. The project continued to develop and receive funding even in the bear market conditions. Polkadot offered an innovative solution for creating interoperable blockchains, which allowed it to stand out among competitors and attract funding.

A particularly striking example of successful investment attraction during the bear market is Solana. This project, despite the challenging market conditions, managed to attract significant investments thanks to its high performance and low transaction costs. Solana positioned itself as a platform for decentralized applications capable of processing thousands of transactions per second, which became a decisive factor for many investors.

These examples show that even during a downturn, it is possible to find ways to attract investments if you offer a truly unique and in-demand solution.

We talked to Vlad, Co-Founder of Synonym Finance, about this topic:

The following trend can be traced: projects are often built during bear market, but they are released during bull market. Was the SYNO launch planned this way?

"Definitely, we started building Synonym Finance in February 2023. Development was happening during the bear market, and took exactly one year. Of course, no one can say for sure when the bull market will come or when the bear market will end.

But the key point is that only those teams who are really interested in the product, technology and infrastructure survive the bear market. Basically, those short term profit maxis go into hibernation or another industry, for example many of them are now in the AI industry.

We knew that sooner or later there would be a bull run, you just have to plow on. What's interesting is that we decided to start the investment round at the end of the bear market, at the beginning of the bull market - around August. We personally watched as interest and valuations grew. If we had started raising in December, valuations would have been much higher."

Of course, the strategy of launching a project during a bull market can be very successful. However, the key factor is the team's real commitment to their product and technology.

Those who are looking for short-term profits walk away from their projects, while true innovators continue to work on their projects despite market conditions.

1.2 History of Cryptocycles

We have already discussed the role of cryptocurrencies in our videos many times.

Now we will try to draw a parallel between the stages of human development and the cycles of cryptocurrencies:

2009 - 2012: Inception - Similar to the beginning of an infant's life, this period was the beginning of crypto's life. The foundation for further development was established, and like a young child, the presence and support of "parents" - developers and early investors - was important.

However, at first, a person is not capable of making informed decisions or any actions on his own. In the same way, crypto did not seem to be something serious, conscious, and independent.

2012 - 2015: Growth and Expansion - At this time, like children who are beginning to actively explore the world, crypto began to actively develop and expand. Drawing more and more attention, it began to form its own niche in the world of finance. During this time, we saw the first "sprouts" of the cryptocurrency world: Ethereum, Metamask, Coinbase.

2016 - 2019: Physical and Emotional Development - During this stage, similar to teenagers going through strong emotional and physical changes, crypto faced large fluctuations in prices and gained increased public attention.

Teenagers often experience excitement and sudden emotional surges. During this stage, we saw the blossoming of ICOs, the beginning of DeFi's development and the first hints of the key points of the next stage - NFT.

2020 - 2023: Mental and Emotional Maturation - As young students enter the stage of life that is considered adulthood, both mentally and emotionally, crypto has become more stable. This time is characterized by a strengthening of crypto's spot in the world of finance and increased public awareness.

Crypto has gotten stronger. It has shown really strong positions, technologies and narratives. However, like any enthusiastic youngster, the market lacked the maturity to stand on its own two feet.

2024 - 2028: Peak Physical and Mental Development - When compared to human development, this is the age when humans reach the peak of their physical and intellectual abilities. During this cycle, crypto is expected to strengthen its position, develop new technologies and breakthroughs, and possibly increase the acceptance of crypto in society.

Everything suggests that this cycle will be the most serious and the brightest so far, being built on the experience from previous years. Crypto is becoming truly self-sufficient and independent. The market has gained the ability to independently decide which direction to take and how to raise resources from within, not externally.

2029-2033: What comes next? - A midlife crisis or Exponential growth? No one is able to say. The market is unpredictable.

However, one thing is certain:

The current phase is a time of youth flowing into maturity. Probably the best time in life.

1.3 Halving as a catalyst for growth

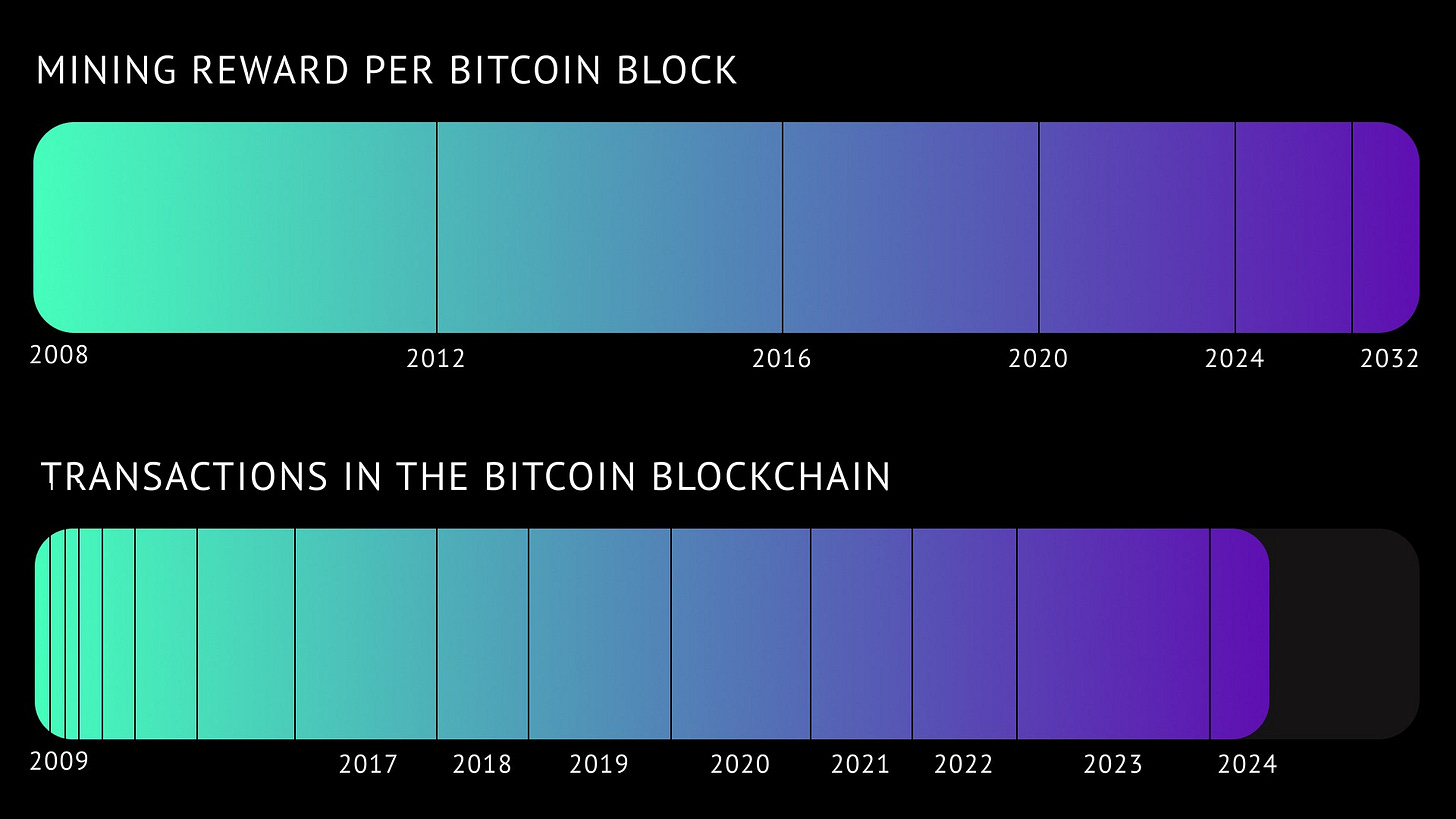

One of the key factors contributing to the bull market is Bitcoin halving, an event where the reward for mining a new block is halved.

A bit of technical detail to clarify the importance of this event:

Halving occurs about once every four years.

It is one of the key events that influence Bitcoin's price performance. This event has profound economic and financial implications that are felt throughout the market cycle.

Bitcoin's supply is limited to 21,000,000 BTC

This number is embedded in the Bitcoin code itself, and it's not just something that can be changed - you need a majority of the network to agree to it.

It is estimated that the last Bitcoin will be "mined" around 2140.

Mining is the process of mining new blocks into the blockchain.

The more people are mining, the more complex the process becomes. This is called the "mining complexity". It can vary depending on the number of miners.

Hashrate is the speed at which miners can perform calculations.

The higher the hash rate gets, the more miners can find new blocks faster and earn rewards.

However, in addition to technical features, halving also has an important psychological impact on the market.

It creates a sense of scarcity and uniqueness in assets, which can stimulate demand. In addition, reducing the reward for mining makes mining new coins less attractive, which can lead to an increase in the value of existing coins.

It is important to note that Bitcoin's halving is taking place amid increased interest in cryptocurrencies from institutional investors. This creates additional prerequisites for price growth, as institutional investors usually have a longer-term investment outlook and can drive demand for the asset.

Halving is not always a direct indicator of cryptocurrency growth. The mechanisms of the market device are much more complex than it seems at first glance. You are unlikely to get rich buying Bitcoin every 4 years.

Expectations are already embedded in the price of the asset.

For example, JPMorgan argued that the price of $BTC may drop to $42K already as soon as the halving-induced euphoria subsides.

The date of halving was April 20, 2024

After that, the rewards for a mined block dropped by half: from 6.25 BTC to 3.125 BTC per mined block.

But it's not just halving that suggests the coming cycle is perhaps a pivotal period in the life of cryptocurrencies.

Continuing the rhyme about the development of cryptocurrencies and humans, the following analogy can be made:

A young student finishes university, gets a diploma and, most importantly, confidence in his or her own abilities.

In the same way, the cryptocurrency market has kind of received a diploma, or we can even say, graduated - gained institutional support.

1.4 ETFs (what are they?)

The transition into a bull market phase is accompanied not only by expectations of rising prices, but also by changes in market structure and functioning. One of the key differentiators of the current bull cycle is the widespread adoption of exchange traded funds (ETFs), which play a significant role in the structure of today's financial markets.

You can now hear from everywhere about the adoption of Bitcoin ETFs. This event is indeed a fundamental game changer for cryptocurrencies, but do you know what's behind those three letters - ETFs?

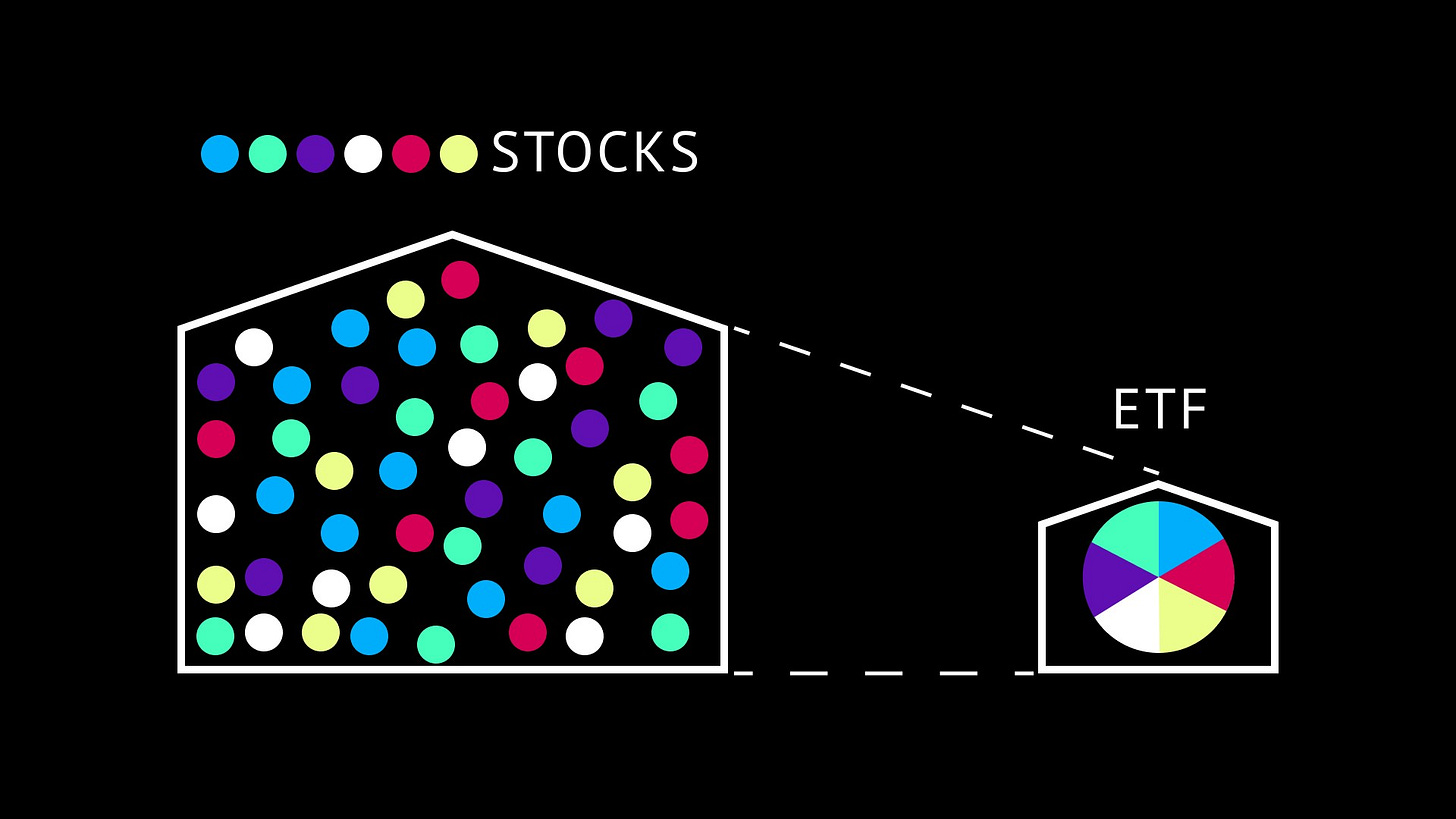

ETFs, or exchange traded funds, are investment funds traded on an exchange, similar to stocks. They combine the features of stocks and investment funds, giving investors access to a wide range of assets and investment strategies. ETFs reflect the value of an entire set of assets, such as stocks, bonds, commodities or other investment products, and their price changes in line with changes in the value of that set of assets.

The adoption of ETFs in various sectors of the financial market has led to significant change and innovation.

For example, the advent of the SPDR Gold Shares Exchange Traded Fund (GLD) in 2004 changed the approach to investing in gold. GLD allowed investors to gain exposure to the price of gold without having to physically store it, which made investing in gold more accessible and convenient.

We haven't seen the price of gold since the adoption of ETFs.

Similar changes have occurred in other industries thanks to ETFs. For example, the advent of exchange-traded funds that reflect indices of stocks, bonds and other assets has helped diversify investors' portfolios and increase liquidity in the markets.

So what is a Bitcoin-ETF? And what does it mean for the crypto world?

1.5 ETF inflow

Everyone knew when to expect a Bitcoin ETF decision. But no one knew how the adoption would actually affect cryptocurrencies. Would the ETF find its buyer, would it become the bullish case and the reason for the next upswing? Or maybe Bitcoin isn't that interesting to the mass public.

On January 11, 2024, we learned the answer. On the very first day of ETF adoption, inflows totaled over $600M.

Since January 11, there have been huge cash flows to buy ETFs. On average, they've stayed between $200M on the worst days, to $600M on the best days.

Even with the constant pressure from Grayscale, net inflows have totaled over $11B over the three months alone.

There are new players in the market, new stakeholders.

Bitcoin is now one of the recognized vehicles in building any portfolio, not a retail toy.

Bitcoin has never experienced such a stable and massive infusion of funds, and big funds are now forced to recognize its legitimate nature. What's more, it's now even profitable for them to promote Bitcoin, as they make money when they raise more money under management. The largest Bitcoin ETF at the moment is provided by BlackRock.

We may never again see the massive “FUD” (negative sentiment) from financial institutions towards Bitcoin that we saw in 2014, 2017.

The influx of liquidity into ETFs may have changed the way cycles form.

For the first time in history, Bitcoin closed with green candles for 7 consecutive months. From September 2023 to March 2024.

Moreover, Bitcoin broke ATH for the first time BEFORE halving, on March 14, 2024.

And it was due to the influx of funds from ETFs. This has never happened before in history.

In addition, this influx of funds has kept Bitcoin's dominance at a very high level for a long time.

We have yet to see a truly massive inflow of money into altcoins.

Many traders have argued that we should exit the PVP market after this influx of funds, but so far this has only been true for Bitcoin.

Now that we've discussed how the adoption of ETFs has affected cryptocurrencies, let's move on to a more global view.

How have these changes affected the macroeconomic picture as a whole?

Let's take a look at the excitement they have generated in the market and what trends have become more prominent on the macro-level horizon.

Approval of an Ethereum ETF

In May 2024, the U.S. Securities and Exchange Commission (SEC) approved the first Ethereum Exchange-Traded Fund (ETF), marking a significant milestone in the history of cryptocurrencies.

This decision was long-awaited and notable, signaling the growing recognition and institutional acceptance of digital assets.

The approval of the Ethereum ETF was not instantaneous and went through numerous stages. Initially, the SEC delayed decisions on ETF applications submitted by major financial players such as VanEck, BlackRock, and ARK 21Shares. In the first few months of 2024, there was lively discussion among regulators and market participants regarding the feasibility and safety of such investment products.

SEC Chairman Gary Gensler repeatedly expressed concerns about market manipulation and the lack of adequate regulation. However, with increasing pressure from institutional investors and the general trend towards the acceptance of digital assets, the SEC decided to reconsider its position.

Significance of the Event

The approval of the Ethereum ETF was a turning point for the cryptocurrency market. It not only confirmed the legitimacy and investment appeal of Ethereum but also opened new opportunities for institutional investors. This event also led to a significant rise in the price of Ethereum, which increased by 23% within 24 hours of the announcement, reaching a level above $3,700.

The approval of the Ethereum ETF sparked a wave of enthusiasm and active investments. On the first day after the approval, the inflow of funds into the ETF amounted to more than $500 million. It is predicted that this inflow will continue to grow, which may lead to a further strengthening of Ethereum's market position.

Analysts suggest that the price of Ethereum could reach $4,000 and higher, based on the successful launch of the Bitcoin ETF, which led to significant institutional inflows and the price of Bitcoin reaching a new all-time high.

The approval of the first Ethereum ETF marks a new era for institutional investments in cryptocurrencies, providing investors with a regulator-approved way to invest in Ethereum.

This event not only enhances the liquidity and stability of the market but also contributes to the broader recognition of Ethereum as an investment asset. The success of this ETF could stimulate further growth and innovation in the blockchain and decentralized finance industry, opening new horizons for the development of digital assets.

1.6 New highs for Bitcoin in emerging markets

Bitcoin saves emerging markets

Like a storm sweeping away everything in its path, Bitcoin has swept through emerging markets, reaching unprecedented heights. In countries where national currencies are cracking on the seams under the weight of economic problems, cryptocurrencies have become a lifeline for millions of people.

In Turkey, Argentina, Venezuela and other countries where inflation and devaluation have long been a common evil, Bitcoin has broken all records. Local residents, tired of the constant devaluation of their savings, saw in cryptocurrency a reliable refuge from financial storms.

People are voting with their wallets, preferring to keep part of their savings in "digital gold", protected from the whims of the authorities and the vagaries of the economy.

The influx of retail investors into local crypto exchanges like Turkey's BtcTurk, Argentina's Ripio, and Nigeria's BuyCoins has led to an explosive growth in trading volumes.

Bitcoin is rapidly penetrating the fabric of emerging economies, changing the financial landscape.

BlackRock is entering the Brazilian market

While ordinary investors are seeking salvation in Bitcoin, Wall Street's biggest players are also rushing to take their place in the crypto revolution. And in a landmark development, asset management giant BlackRock has decided to launch Brazil's first bitcoin exchange-traded fund (ETF).

On March 1, an ETF called the iShares Bitcoin Trust ETF BDR (IBIT39) began trading on Brazil's largest exchange, B3. This will essentially be a "wrapper" over the successful bitcoin ETF that BlackRock recently launched in the US. This structure would give Brazilian institutional investors a simple and regulated way to gain direct exposure to bitcoin.

The success of a similar ETF in the U.S., which raised $8 billion in a couple months, speaks loudly about the huge demand for direct bitcoin investment among institutional investors.

And now this demand will come to the Brazilian market as well, legitimizing BTC in the eyes of even the most conservative investors.

Explosive growth of stablecoins

While Bitcoin is making its way to the Olympus of finance, the real revolution is taking place in the world of stablecoins - cryptocurrencies tied to traditional assets like the U.S. dollar. These "digital dollars" have become a crucial part of the crypto-economy, and their issuance is growing like crazy.

Market leaders like Tether (USDT) and USD Coin (USDC) are printing stablecoins in trillions of dollars. The total capitalization of stablecoins has passed $150 billion, which is more than the GDP of many countries!

This explosive growth reflects the huge demand for stable digital assets:

For traders, stablecoins are a safe haven during storms in the crypto market.

For businesses - a convenient means of settlement, not depending on the volatility of BTC or ETH.

For ordinary people - an easy way to enter the world of cryptocurrencies without risks and technical difficulties.

In developing countries, stablecoins have become the salvation of millions of people cut off from US dollars and safe savings.

Not surprisingly, regulators are keeping a close eye on this market, demanding transparency and accountability from issuers. But the overall trend is inevitable - stablecoins are becoming an integral part of the financial landscape.

Crypto oasis in the regulatory desert

While some countries are trying to tighten the screws and curb cryptocurrencies, others, on the contrary, are opening their doors to blockchain innovation. UAE, Hong Kong, Australia and a number of other jurisdictions have seen the crypto industry not as a threat, but as an opportunity to attract the minds and capital of the new digital economy.

For example, UAE, the pearl of the Gulf, which has long been a magnet for tech startups.

In 2022, Dubai passed crypto-friendly legislation and created a special economic zone with tax incentives and a simplified visa regime. No wonder giants like Binance and Crypto.com rushed to open offices there.

Hong Kong, having recovered from the turmoil caused by China's repressive policies, has also decided to become a cryptocurrency hub. The local regulator proposed clear rules for licensing crypto exchanges and custodial service providers. Exchanges were granted legal status and retail investors were allowed to trade the largest crypto assets.

Even conservative Australia has softened its stance, abolishing double taxation of cryptocurrencies and recognizing DAOs as a legal form of business. And the Reserve Bank is preparing to launch a digital currency pilot.

These crypto oases are the exception rather than the rule amid global regulatory uncertainty. But they clearly show that the future lies with those who are not afraid to experiment and innovate.

After all, it is precisely in such points of attraction the breakthroughs capable of turning the global economy upside down will be created.

Cryptocurrencies are becoming the new center of attraction

Not so long ago, bitcoin and other cryptocurrencies were perceived as something marginal. The ups and downs of the crypto market were explained by Fed decisions, correlation with the S&P 500 index, and Elon Musk's tweets. But those are things of the past.

Today, the crypto economy has grown into an independent force with a capitalization of trillions of dollars, a developed infrastructure and an army of followers. Bitcoin and Ethereum have established themselves as macro assets to which corporations and entire nations look up to.

No longer is Bitcoin pegged to the dollar, but rather the dollar looks back at Bitcoin:

Crypto capital inflows or outflows affect bank balance sheets, stock indexes, and commodity prices.

Decisions by authorities regarding cryptocurrencies are instantly reflected in global financial flows.

The actions of "cryptowhales" are capable of causing a domino effect on traditional markets.

In other words, we are witnessing a tectonic shift where crypto economics is transforming from a passive recipient of macroeconomic signals to an active creator of them.

It is no longer just another asset class, but a fundamentally new paradigm of value and interaction in the digital age.

Conclusion: Welcome to the new world.

1.7 Crypto Influencing Macro, Not the Other Way Around

The cryptocurrency revolution is gaining momentum, and its epicenter is shifting towards developing countries.

Regions that were once on the periphery of the global financial system are now becoming the source of growth and innovation in the blockchain and digital assets realm.

India is showing an incredible appetite for cryptocurrencies: the country has 115M crypto investors - 15% of the population. Ranked third in the world in terms of Web3 talent, it is actively adopting blockchain on the government level.

For example, authorities are using the Polygon network to fight corruption and improve governance. And local crypto exchange CoinDCX became the country's first cryptocurrency "unicorn" with a valuation of [over $1 billion] All of this just underscores India's huge potential as one of the future centers of the crypto economy.

Africa and the Middle East are also showing impressive growth in the cryptocurrency market. It has grown by a record number of 1200% in 2021. Nigeria is leading the way in terms of interest in cryptocurrencies, overtaking even the US. The CAR has legalized Bitcoin, and the UAE is creating special economic zones for blockchain companies.

Southeast Asian countries such as Vietnam, the Philippines and Thailand are consistently in the top 10 on the global cryptocurrency acceptance index. About a quarter of the population in Vietnam and the Philippines earn money by playing blockchain games. This region is leading in retail crypto payments as well.

Latin America is considered one of the vanguards of the crypto revolution. El Salvador was the first country in the world to adopt bitcoin as legal tender. Argentina, Brazil, Colombia and Mexico are among the top 20 in cryptocurrency adoption.

95% of crypto transactions in the region are everyday retail payments.

Developing countries are becoming the drivers of the crypto economy. High rates of adoption among the population coexist with progressive initiatives by businesses and regulators.

Demographic and technological trends are creating fertile ground for the proliferation of digital currencies and related innovations.

Cryptocurrencies have reached a level of development and influence where they have become a force on their own, capable of setting the tone in global markets.

This is a special moment, marking the beginning of a new era in the history of money and finance.

Cryptoeconomics forms a parallel financial reality, living by its own laws and rules. This reality is becoming an increasingly important part of the global economic architecture. With each new cycle, the correlation between cryptocurrencies and traditional markets is weakening.

Cryptocurrencies have become an integral part of the new economic reality where miners, holders and industry leaders set the tone and define the rules of the game.

The question is no longer how the macroeconomy will affect Bitcoin, but how Bitcoin will affect the macroeconomy.

The answer will determine the trajectory of global finance in the coming years.

Part 2: Narratives of the coming cycle

2.1 GameFi

Gaming industry was born back in the 1970s. Atari released the first game, Pong, and the first game console, the Atari 2600. What followed is colloquially referred to as the "golden age" of video games.

In 1981, arcades generated nearly $5 billion in revenue in the United States. This is a huge amount, which in terms of today's dollars is more than $16 billion.

Even then, the Gaming industry had a small impact on the macroeconomic component of countries.

But who would have thought that this industry would only grow and a few decades later it would force entire states to write new laws and regulations to regulate the economy within an entire country?

Now let's take a look at where it all started and how cryptocurrency has affected the Gaming sector.

The gaming industry has grown tremendously since the 1970s, transforming from a technological novelty to a major economic force.

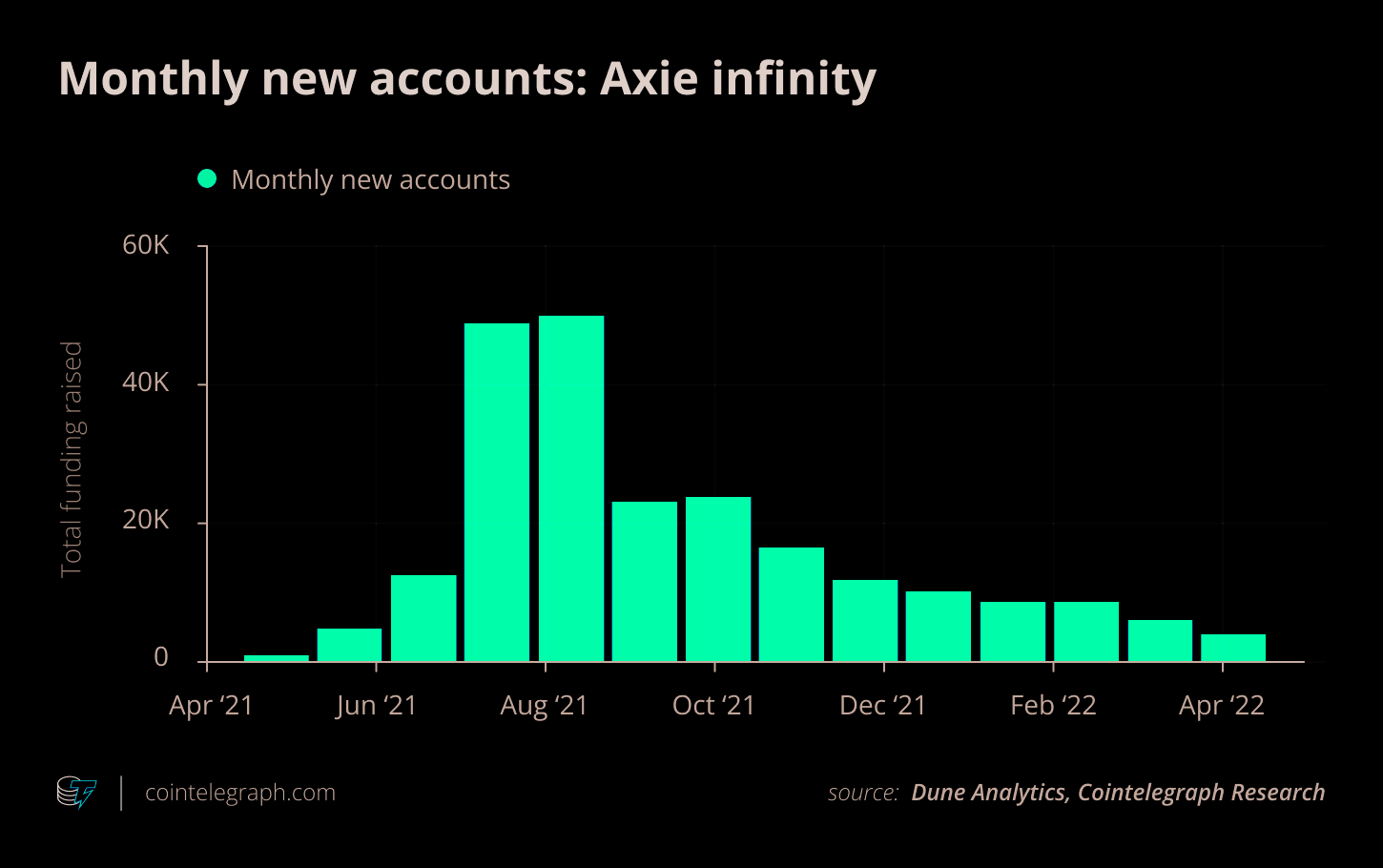

We saw a particular surge of engagement in the GameFi sector during the COVID-19 pandemic.

As people were forced to stay at home and mostly out of work, the demand for online gaming skyrocketed.

But since the crypto industry at this time was just gaining momentum and offered an opportunity to not just play, but also earn money at the same time, this could not help but attract attention.

A large portion of the population of different countries entered the GameFi sector to earn crypto, which for many became the most important source of income during the economic downturn.

In the Philippines, a large portion of the population is heavily involved in P2E, and as such, the government of the country has decided to come up with a number of laws to regulate the process.

Or, for example, in countries facing economic instability and hyperinflation, such as Venezuela, GameFi happened to fill the need for an alternative source of income for some individuals.

By playing games and earning crypto, Venezuelans found a more stable alternative for generating income and transferring funds than their national currency, as it was simply more profitable (remittances accounted for 5% of the country's GDP).

This phenomenon showed the potential of GameFi to support lives back then and also raised questions about sustainability and regulation.

A case in point is India. In 2021, this country was ranked second in the cryptocurrency adoption ranking, but in 2022 it was fourth.

The reason for the decline was the tax imposed by the government of 30% on cryptocurrency gains, as well as an additional fee of 1% for each transaction.

Despite everything, the global gaming market continued to grow and in 2023 brought in $184 billion in revenue and the number of gamers reached 3.38 billion.

Many regions of the world saw growth in 2023, with the US and China accounting for 49% of all consumer spending on gaming. Although the Middle East and Africa accounted for 4.7% of total revenue worldwide, the market showed impressive growth (+4.7% year-on-year). Asia Pacific accounted for 46% of total gaming revenue.

As we can see, the Gaming industry is paying off. And if we talk about the industry's impact on the macroeconomy, there are both positive and negative aspects:

Unemployment

On one hand, the development of the sector creates new jobs related to game development, blockchain project management, marketing, user support and other specializations within the crypto economy. This can help reduce unemployment among skilled workers in the technology and creative industries. On the other hand, automation and digitalization driven by blockchain technology adoption may lead to job losses in traditional sectors of the economy.

International payments and transfers

As we've covered above, the use of cryptocurrency makes international transfers much easier and more profitable, facilitating globalization and international trade while affecting exchange rates through changes in capital flows. And it is largely thanks to GameFi that early investments have grown in a large number of countries.

According to a study by the Atlantic Council, cryptocurrencies are fully legal in 32 countries, partially banned in 19 countries and completely banned in 8 countries. In all G20 countries, regulation is under consideration.

All of the above can tell us that GameFi is revitalizing the economy and has an impact on the macroeconomic health of countries.

What is the outlook for the industry going forward?

A lot of projects are released every quarter and each one has the potential to be the key to mass adoption.

At the moment, only about 27% of projects have been released that are ready to be released in the new phase of the bull market.

We can look at a few recent projects that were launched: Farcana, Shrapnel, Nyan Heroes and so on. Many of them are still in beta.

However, the question remains:

Is the GameFi sector ready for users to abandon familiar Web2 games in favor of Web3 projects?

Perhaps it would be logical for the sector to adopt already popular games and introduce crypto there to attract people?

And it will be easier than inventing the wheel and waiting for performance.

Of course, this does not apply to all games.

Let’s take Notcoin as an example. Many people have registered their children, parents and friends to mine tokens. Many people have touched the crypto world through Notcoin.

This is a huge breakthrough in terms of crypto mass adoption. More than 30 million users in just a few months of the project's existence.

The example of Notcoin demonstrates how cryptocurrency projects can achieve unicorn status through innovative approaches and active user engagement.

Impressive growth and active community participation attracted the attention of major investors such as Binance Labs. Support from such influential players added credibility to the project and contributed to its successful listing on leading cryptocurrency exchanges, including Binance.

In conclusion, GameFi is revitalizing the economy and has an impact on the macroeconomic health of countries.

The sector goes beyond the simple symbiosis of gaming and finance, representing a powerful catalyst for economic and social change on a global level.

Through innovation and technological breakthroughs, it offers new opportunities for economic growth, financial inclusion and social interaction.

However, thoughtful regulation and support from governments and regulators are needed to realize its full potential and ensure a sustainable impact on countries' macroeconomics.

2.2 Metaverse

"The true possibilities of the metaverse will come to life when it becomes a fabric built from digital experiences rooted or embedded in the physical world"

©Daniel Deese, CTO of Magic Leap

Why aren't meta-universes over ?

The connection between meta-universes and AI

The future of meta-universes

If you haven't been immersed in the topic of meta-universes for the last year, you might think that interest in this field is slowly fading, as the number of users has decreased, investment rounds have shrunk, and in general the focus has shifted to the fresher and more promising field of artificial intelligence.

But this is just the tip of the iceberg, and in this part of the article we will analyze why the metaverse is not over yet, what future awaits it and why AI does not supplant metaverses, but complements them.

The metaverse has lost some of its luster. Once a ubiquitous buzzword that prompted Facebook to change its name to Meta Platforms Inc. the hype around new digital worlds has subsided as the tech industry has shifted its focus to artificial intelligence.

However, McDonald's said the meta universe and AI will go hand in hand: "Right now the hype is underestimating the impact, anyway" and celebrated the 40th anniversary of Chicken McNuggets chicken nuggets in The Sandbox meta-universe.

Land in The Sandbox attracts not only McDonald's, but also other major global brands such as Shemaroo Entertainment, BBC Studios and Forbes.

Other meta-universes we know have not remained stagnant either, with Yuga Labs laying off staff and focusing on meta-universe expansion amidst restructuring, the company will focus on expanding its community and brand engagement by "going all-in" on expanding the Otherside meta-universe and supporting internal development going forward.

So how are Web2 companies doing in this sector?

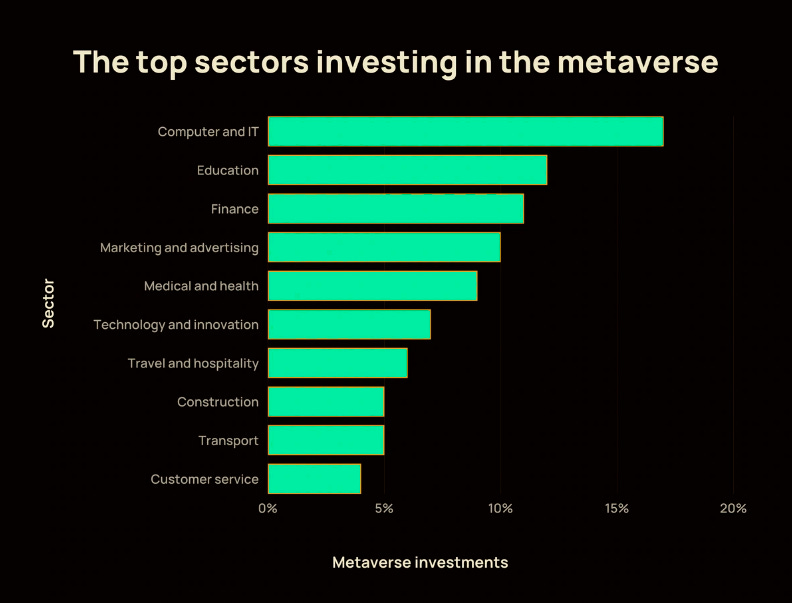

Walmart, the world's largest retailer by revenue, has announced that it is experimenting with new ways to bring together its customers' physical and virtual shopping experiences in a metaverse. According to Citi, by 2030, the total market for metaverse-related commerce will be between $8 trillion and $13 trillion, and the total number of metaverse users will be about five billion.

Virtual worlds and games are also projected to be the fastest-growing entertainment category, with a projected 3 billion participants across all geographic and demographic groups.

Apple, which has released the most popular augmented reality headset to date, Apple Vision Pro, will get the first crypto-centric Metaverse app from Victoria VR.

Victoria VR, is a virtual reality MMORPG with realistic graphics, built on Unreal Engine and blockchain. The project has raised $14 million in funding. The project's meta universe consists of "ultra-realistic graphics and immersive gameplay" that will be able to complement Vision Pro technology.

But the main factor proving that meta-universes have the right to exist and will be developed in the future is that whole countries want to be involved in this narrative!

European Union lawmakers want to develop virtual worlds that support EU business.

China is convening Huawei, Tencent and Baidu to develop meta-universe standards in an effort to become a global technology leader.

The UAE government submits a technical paper on how to regulate the Meta Universe.

News like this makes us realize that meta-universes are still only at the beginning of their journey and it's only a matter of time before the field is universally adopted.

What about the competition between AI and the Metaverse?

Artificial Intelligence has indeed pulled the attention of users, investors and developers to its side, but in no way can we say that it hinders the development of metaverses, rather the opposite - AI complements metaverses and expands their capabilities.

"In 2024, the convergence of AI and metaverse will be a key event in our technological journey. We are on the cusp of witnessing AI transforming the act of creation in the meta-universe. This year, we predict that AI will go beyond its current capabilities, allowing users to create vast virtual worlds simply through the power of description. The meta-universe will no longer require sophisticated 3D modeling and animation skills; instead, it will respond to the creative impulses of human thought brought to life by AI''

©Yemel Jardi, co-founder of Decentraland Foundation.

Let's break down exactly how AI affects the metaverse:

Artificial intelligence optimizes data processing, reducing latency and providing a smooth and immersive experience for users.

It analyzes user preferences and behavior, recommending exactly what a particular user likes.

AI monitors resource utilization and adapts infrastructure in real-time, ensuring smooth operation and efficient resource allocation in the meta-universe.

Processes natural language: understanding and responding conversationally to user input.

Analyzes user facial expressions and body language to improve interaction.

Creates unique content including images, code, and even virtual worlds.

So what is the future of metaverses?

Metaverses will not only be used for fun and games, their application is much more extensive than it may seem at first glance.

Imagine medical students who instead of looking at pictures of the human circulatory system, will be able to walk inside every vein and artery, or city officials who are modeling how the launch of a new bus route will affect the infrastructure of the city.

Metaverse will be widely used at work and in schools. More than 50% of people said they look forward to using Metaverse for professional use.

In addition, by 2026, a quarter of people worldwide will spend at least one hour in the Metaverse for personal use.

Approximately 60% of gamers have already used the Metaverse for virtual experiences not directly related to gaming.

On the cusp of breakthroughs, virtual reality is set to radically change our sensory experience in digital spaces, opening up new opportunities for us to socialize, learn and be entertained.

Let's not stop at the brink of this potential breakthrough, but actively explore and incorporate virtual reality into our daily lives.

The Metaverse is opening new horizons for creating virtual worlds, social interactions, and economies. In 2023, many exciting projects have emerged, gaining attention for their innovative approaches and technologies. For those looking to delve deeper into the metaverse, we recommend exploring these projects:

RLTY - This startup offers a no-code platform for creating 3D immersive experiences in the metaverse. RLTY combines virtual reality, cloud computing, blockchain, and a game engine to organize concerts, festivals, art exhibitions, and more. The platform also allows for managing access rights and easily attracting 3D artists to optimize events. Project website

Sensorium Galaxy - A digital metaverse developed in collaboration with world-renowned artists and producers. The Sensorium Galaxy metaverse includes several worlds, each dedicated to specific experiences such as music and entertainment, virtual reality, and self-discovery. The platform uses the SENSO token for transactions and content creation. Project website

Bit.Country - A Singaporean startup offering "metaverse as a service." The platform allows users to launch their own metaverse projects, providing integration with an NFT marketplace, map engine, land economy, and customizable 3D engine. Project website

Edverse - An Indian startup creating an educational metaverse. Edverse uses Polygon and Elysium blockchains to create a decentralized network, providing space for virtual classrooms, alumni meetings, and collaborative sessions. The platform also includes a library of educational 3D assets and tokenomics to incentivize participants. Project website

Veyond Metaverse - An American startup developing a metaverse for healthcare. The platform uses extended reality (XR), virtual reality (VR), and AI to enhance collaboration and interaction among medical professionals, offering opportunities for remote learning, training, and joint operations. Project website

Let's step boldly into a future where virtual reality will become an integral part of our existence!

2.3 Account Abstraction

The history of security: from private keys to Account Abstraction

Bitcoin Core, the first cryptocurrency, brought us the simplest (in terms of implementation) principle of cryptocurrency wallets from cryptography. It is based on private and public keys.

The public key plays the role of address and confirmation of the transaction, which is signed by the private key.

Simply put, we can draw an analogy with bank cards, where the public key / wallet address is the card number, and the private key is its password. Whoever knows this password has access to the funds on the card.

Nevertheless, the principle of Bitcoin Core had many disadvantages in terms of user-friendliness.

Bitcoin works according to the UTXO accounting model, where the change in most cases was sent to a new public address with a new private key. This created quite a large number of private keys that were constantly changing hands.

Taking into account that private keys were a set of letters and numbers, it made the storage of such keys as inconvenient as possible. And the only solution at that time was to store the keys encrypted in a special file. This led to several points of failure:

Forgotten password. If the user forgot the password to this file, they lost all their funds.

Lack of backup. You may have often heard stories of discarded disks with huge amounts of bitcoins.

Malware attacks. The file was in a vulnerable environment. And those who didn't care about the security of their device often suffered malware attacks, causing them to lose their cryptocurrency.

In 2012-2013, two key standards BIP32 and BIP39 brought the convenience and security we have now to the world of cryptocurrencies. BIP32 added deterministic wallets, which allowed the creation of an almost infinite number of wallets with just one private master key:

The BIP39 standard described a method for creating a mnemonic phrase to generate private and public keys.

Most of us are used to this method of storing the private key in wallets.

Later innovations such as passphrase (13th word) and multi-signatures were introduced. Over time, even forms of security improved: hardware wallets appeared - devices that stored private keys in an isolated environment.

A wallet appeared that stored the private key in such a way that no one, not even the user, knew about it.

But there is still one problem: the user has to worry about backups and has to do it completely manually. Those who have studied the security aspects of cryptocurrency know that you can't recover a lost seed phrase, so it is necessary to have several backups, which should be stored in a safe offline environment and in different places. For a simple user who doesn't want to get into the intricacies of security such a process looks too complicated.

And as a result: users were given the opportunity to eliminate the points of failure that existed in the principles of private key storage, but not everyone used it because of ignorance/inconvenience.

It's been 5 months. What has changed?

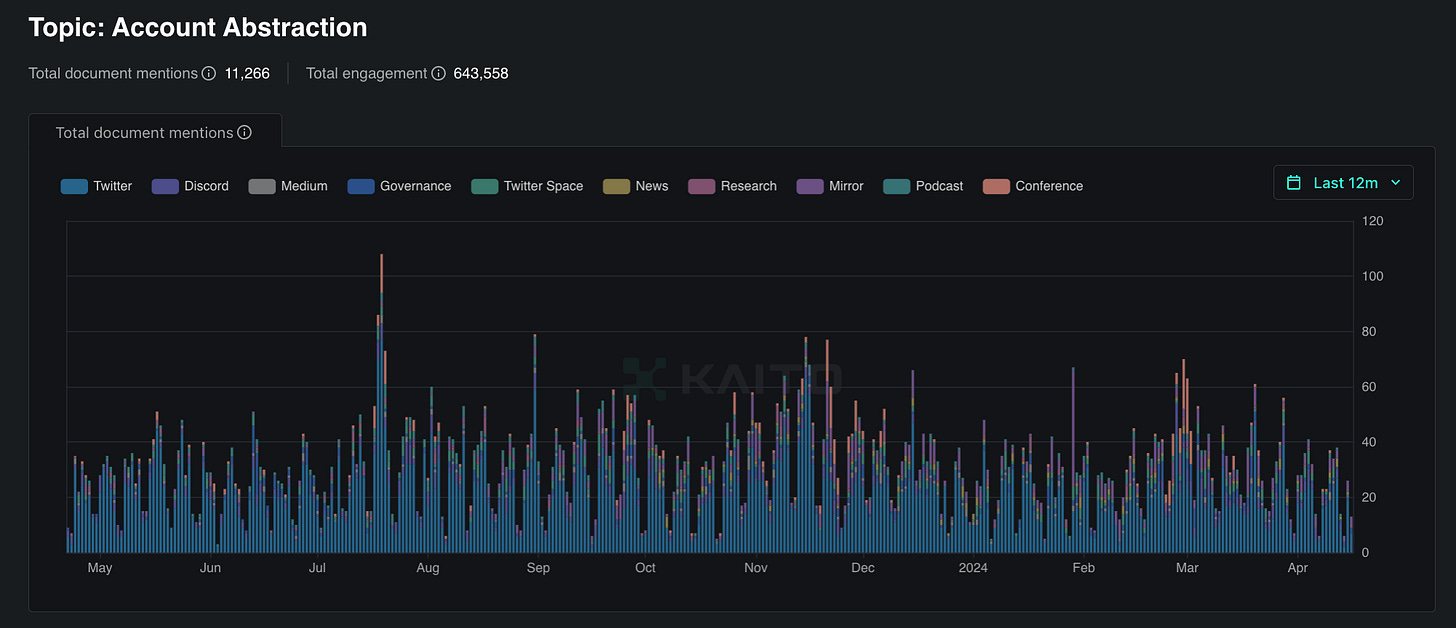

One of the trends for the upcoming cycle is Account Abstraction.

In a nutshell: Account Abstraction are wallets that are created using smart contracts. Such wallets can be linked to social accounts like Google and do not require a mnemonic phrase.

Let's take a look at the statistics from Dune Analytics:

As you can see, every 3-4 months the number of users increases by 3 times. And this growth rate has been going on for a year:

Probably the most significant event in the last 5 months was the integration of smart accounts into Trust Wallet - the 3rd most popular wallet on Android for 2023:

Swift wallets were launched on February 29, 2024.

These are non-custodial wallets, while not requiring the user to memorize a passphrase.

The key is encrypted on a Google or iCloud server using HSM so that neither Google nor Apple has access to these keys.

You can lose access to the wallet only if the user deletes the passkey from the password manager or loses access to your Google/Apple account.

Swift wallets are already supported in 7 EVM networks and allow you to pay for gas with more than 200 tokens (Paymaster).

These wallets have their drawbacks.

For example, the inability to restore a wallet on iOS if it was created on Android. Also, these wallets are not available as browser extensions.

Why is it so important?

Trust wallet is one of the most popular wallets in the world. Many people are introduced to the Web 3 world with the help of this wallet. And this innovation brings Web 3 closer to mass adoption, as it makes it much easier for newcomers to log in.

Users no longer need to understand the principles of cryptocurrency wallets, they no longer need to worry about how and where to store the seed phrase, and they no longer need to understand how gas payments work.

Considering the fact that smart accounts are growing in popularity in a big way, everything is going towards the fact that this will be one of the most in-demand areas in the coming cycle.

A less important, but still significant update regarding the ERC-4337 standard is the use of the gas paymaster feature on Dex on the ZkSync network. For example SyncSwap, the Dex with the largest TVL in ZkSync already uses this feature. Orbiter Finance, one of the largest bridges, also allows you to pay for gas with one of many tokens. And best of all, it doesn't require you to create a smart account:

A look into the future of smart accounts

The possibilities of smart accounts go beyond not having a mnemonic phrase and paying for gas with a variety of tokens. Since a smart account is itself a smart contract, it opens up almost unlimited possibilities.

For example, the user can set transaction limits for applications and require additional verification (e.g. from another wallet) if the limit is exceeded.

Or, for example, such wallets allow users to connect subscriptions to services.

Reminds you of banking apps, doesn't it?

Only unlike banking apps, such wallets allow you to fully manage your assets and permissions.

Another interesting feature of smart accounts are "session keys", which allow apps to automatically sign transactions for a certain period of time.

This is especially useful in the GameFi realm, where constantly pop-up signature windows interfere with gameplay.

On one hand, such features provide convenience. On the other hand, those who use these conveniences pay with their trust in the services.

In the future, it is likely that the average user may have to trust not only the wallet that generates the key, but also the services that store it.

The use of session keys without a time limit may lead to an excessive trust in dApps, since the wallet will be able to automatically sign any malicious request from the dApp if hacked.

Nevertheless, the advantages of smart accounts clearly outnumber the disadvantages. One must realize that smart accounts are not a panacea against malicious attacks. Any improvement in defense mechanisms also improves the skills of fraudsters/hackers. However, in any case, account abstraction is the inevitable future.

Account Abstraction improves blockchain interactions, making them more accessible and user-friendly. It significantly simplifies the use of smart contracts and enhances transaction security. For those interested in exploring this topic further, we recommend looking into these projects:

Argent - One of the leading smart contract wallets focused on onboarding crypto newcomers and operating on Layer 2. Argent offers social recovery, multi-signature, stablecoin gas payments, and transaction batching. Project website

Safe (formerly Gnosis Safe) - A platform for decentralized asset storage and collective management on Ethereum. Safe leverages ERC-4337 to enhance the user experience, offering multi-signature, asset management, and other features. Project website

Biconomy - A platform that simplifies dApp development through easy-to-use APIs and SDKs, supporting multi-currency transactions and cross-chain transfers. Biconomy actively implements account abstraction features, providing gasless transactions and improved user interactions. Project website

Holdstation - A wallet focused on zkSync, offering a gasless experience and supporting Paymaster functionality. Holdstation is actively developing its product, including launching a fair token launch platform and issuing the $HOLD token. Project website

Ambire Wallet - A smart contract wallet supporting over 10 EVM chains, offering stablecoin gas payments, multi-signature, and transaction batching. Ambire also includes an intuitive interface for asset management and token swapping. Project website

These projects demonstrate various approaches and innovations in account abstraction, enhancing the security and usability of crypto wallets.

2.4 R.W.A.

How to sell the Mona Lisa painting to a thousand people at once?

How to collect money in a shared business and evenly calculate interest between investors with "one button"?

How to "transfer" a gold bar to a new owner without physically moving it?

These questions are asked and answered by an important niche of the cryptocurrency sector called RWA.

RWAs (Real World Asset) are tokens, a digital form of real world assets that have a digital representation on the blockchain. These assets can be physical or financial assets such as real estate, securities, precious metals, artwork and other assets that have real value in the real world.

The emergence of this DeFi segment was inevitable given the evolving mass-adoption and the incessant questions of "how else can we simplify our lives with the technology available to us?".

Realizing that the blockchain is a huge Excel spreadsheet of data cells that can be changed, rewritten, moved and merged, while being able to track all actions from the oldest to the most recent, it was only a matter of time before a bridge was created between real world assets and digital assets.

The simplest and most straightforward example that most people involved in cryptocurrency use are the stablecoins - USDT, USDC, and other real-world asset-backed stablecoins.

(For the purposes of this article, we won't delve into the ongoing debate over the "illegitimacy" and unsecured nature of USDT with real dollars, securities and bonds 100%. In this context we consider them more from a "scientific" point of view).

By getting and running the technology for a decade, one can derive its advantages, which can be applied and scaled to other segments.

This is exactly what gave rise to RWA.

Here are a few of the strengths:

Transparency and security: Smart contracts allow you to track all the necessary variables - supply, number of holders, transactions and most importantly, any changes at any point in time. Hence the following point:

Speed: Without being hardwired to a physical location, there is an opportunity to participate from anywhere on the planet. You can own tokens of a house under construction in Dubai while being in Singapore, and you can hold securities of an American company even if you are a resident of another country where it is not possible to trade such instruments.

Liquidity: Andy Warhol's most expensive painting "Silver Car Crash" was sold on the auction for 105.5 million dollars. The average cost of an apartment in Dubai's Jumeirah neighborhood is $1.5 million. Tokenization of such objects will allow the purchase of a proportional fragment of them, not the whole thing. This will provide an inflow of a huge amount of liquidity into the market from those people whose deposits do not yet allow them to buy such assets for full value. Given that syndicate forms of investment in the venture capital market are commonplace, this practice could easily move into crypto as well, especially if it is backed by all the advantages of blockchain. And here we get another strong point:

The absence of third parties: A point that is directly related to transparency and security. If a smart contract, rather than a human being, collects an asset, the human factor is eliminated and the risk of incorrect calculations is reduced.

Can BTC-ETF be considered as a reverse example of RWA? Is a bitcoin spot ETF a digital asset in the real world (Asset in Real World)?

We see that the bridge between the digital world and the physical world is getting stronger and wider. And while these are the first steps so far, at some point the movement will be rapid. Considering that range of RWA applications is quite wide:

Commercial securities: Projects offer digital stocks or bonds, using blockchain technology to simplify the issuance and trading process.

Precious metal tokens: Companies can offer digital tokens backed by real stocks of precious metals such as gold or silver.

Real estate on blockchain: Some companies offer real estate tokenization, allowing investors to purchase small stakes in real estate through tokens on the blockchain.

Artwork: Art collectors and art enthusiasts will be able to acquire and exchange valuable paintings, installations and art objects much easier.

What examples already exist in the market and what solutions do they offer?

Polymesh (POLYX)

A specially designed blockchain for regulated assets. Enables transactions with security tokens thanks to 5 key pillars:

Governance

Identity

Compliance

Confidentiality

Settlement

Clearpool (CPOOL)

The first decentralized lending marketplace that allows institutions to access lending and borrowing cryptocurrencies directly from DeFi.

TokenFI (TOKEN)

A platform whose mission is to allow anyone with no experience or code knowledge to create RWA tokens.

Centrifuge (CFG)

A protocol that brings RWA assets to the on-chain, enabling the construction of an "improved financial system".

Borrow cryptocurrency against real-world assets to access DeFi bypassing banking bureaucracy.

Which projects should those interested in RWA look at? Generally, any. You should not look for super-early alpha here, because even the projects already operating on the market are at the very initial stage.

TVL of some of them does not even reach $1 million, so keeping in mind that the industry is forecasted to grow to $16 billion by 2030, it is enough to study the current solutions in order not to miss the growth.

2.5 DePin

DePIN History

DePIN (Decentralized Physical Infrastructure Network) is a concept that has caught the attention of many crypto market participants. Since 2021, industry old-timers are familiar with terms like "MachineFi", "PoPW", "TIPIN" or "EdgeFI", which were used to refer to "decentralized physical infrastructure" at different stages of its development. Even well-known Vitalik Buterin, co-founder of Ethereum, started reminiscing about it.

The term DePin itself was first mentioned and popularized by the analytical company Messari. It all started with a seemingly ordinary post on Twitter, but this publication started the discussion of a new trend in the crypto industry.

What is DePIN?

Essentially, these are networks that require a physical aspect of infrastructure to fully function. Participants of such networks receive project tokens for creating and maintaining this infrastructure. The DePin sector can be divided into two key areas:

Physical Resource Networks (PRNs): these incentivize the deployment of location-dependent devices that provide unique services and solutions tied to a specific geographic location.

Digital Resource Networks (DRNs): in this case, participants distribute unused digital capacity such as memory and computing resources.

Key idea behind DePin

The key idea behind DePin is to create an environment for devices or "Hot Spots" that can collect data, share it amongst themselves and provide rewards to their owners for doing so. The blockchain in this system acts as a transparent coordination and reward layer that determines the value and quality of a deployed Hot Spot and issues the appropriate number of tokens to the network.

In addition, the blockchain allows users to ensure that their personal data is protected, and that all information collection and transmission processes take place in a predetermined manner.

Most DePIN solutions are tied to the utilization of users' redundant network resources. Information is collected, exchanged and accumulated through the concept of IoT (Internet of Things) - a set of material objects connected to the Internet and exchanging data.

Physical Resource Networks (PRNs)

PRNs can be categorized into 4 major subsections:

Wireless Networks - a prime example is the Helium project creating global IoT and 5G networks through custom Hotspots.

Geospatial Networks - here we can highlight Hivemapper, which allows participants to monetize their trips by providing data for map updates.

Mobile Networks - an interesting case study is Drife, a decentralized analog of cab services with payment for trips in tokens.

Energy Networks - an example in this category is Energy Web, which uses IoT devices and special software to optimize electricity consumption and distribution.

“Dynamic maps are ushering in a new era of smart cities and smart mobile applications, from crowd management to autonomous driving."

CEO of Natix, a project specializing in the creation of dynamic maps.

Digital Resource Networks (DRNs)

DRNs include:

Data Storage Networks - Most modern IoT devices utilize servers from large companies like Microsoft and Amazon. While their quality and reliability are unquestionable, high prices and the risk of a one-time failure can be a serious problem. DePIN projects offer a cheaper alternative in the form of renting decentralized storage space.

Compute Grids - allow users to "rent out" the unused computing power of their devices, such as video cards, when not under full load.

Bandwidth Networks - an interesting example is the Grass project, which allows the monetization of excess bandwidth on a user's internet connection without affecting their usual network activity.

Benefits of DePIN

Some of the key benefits of DePIN include:

Decentralization and fault tolerance due to distributed infrastructure

Lower prices for services due to the tokenized rewards model

Opportunity for regular users to monetize unused resources of their devices

The vast majority of Hot Spot owners are independent network participants, so a temporary failure of some devices will not lead to the collapse of the entire system. New enthusiasts will always replace those who have lost interest without serious consequences for the network. In addition, the even distribution of nodes around the world significantly reduces the risk of a "51% attack".

Thus, DePIN, with its inherent decentralization and uptime capabilities, can be a cost-effective alternative to current centralized solutions on the market due to its lower prices through a tokenized participant reward model.

Decentralized Physical Infrastructure Networks (DePIN) are rapidly evolving, offering innovative solutions for building and operating infrastructure. Here are some of the top projects in this space:

Render Network - A decentralized GPU rendering platform that connects users with idle GPU resources to 3D artists and designers who need advanced computing power. The network creates a market for GPU power, significantly enhancing the availability and scalability of high-definition 3D rendering services. Project website

Rowan Energy - Focuses on transforming solar panel owners into active participants in the energy market. Their blockchain-based system allows households to sell excess electricity generated by solar panels back to the grid, incentivizing the use of renewable energy through mechanisms like NFT Carbon Offset Certificates. Project website

Helium Network - A decentralized wireless network for IoT devices, leveraging user-owned hotspots to provide network coverage and reward participants with HNT tokens. Helium recently transitioned to the Solana blockchain to improve scalability and performance. Project website

Arweave - A decentralized data storage network offering permanent and immutable data storage solutions. Arweave’s Permaweb enables developers to build decentralized applications with secure and sustainable storage. Project website

Hivemapper - A decentralized mapping platform launched in 2022 that rewards users with HONEY tokens for capturing high-quality street-level imagery using specialized dashcams. This drive-to-earn model enriches the mapping network and provides incentives for contributors. Project website

Filecoin - A decentralized storage network that transforms the cloud storage market into an open marketplace. Filecoin incentivizes storage providers with FIL tokens, creating a secure and efficient decentralized storage solution. Project website

2.6 Modular blockchains

Modular blockchains, such as Celestia, Eigenlayer, and zkSync Era, have become the major breakthroughs of 2023. Their essence is the division of the blockchain into basic components (consensus, execution, data storage) that developers can freely combine to suit their tasks.

Traditional monolithic networks, such as Ethereum, have faced scalability issues and high fees. The first solutions in the form of sidechains and L2-protocols helped to reduce the load, but did not eliminate the root of the problem.

The radical proposal was a move to modular architecture.

Key layers of a modular blockchain:

Consensus - responsible for selecting the leader and ordering transactions (Celestia is an example).

Executive - executes transactions and updates the state of the virtual machine (zkSync Era).

Data Availability - stores transactions, logs, and account states (Celestia).

Inter-layer communications - protocol for exchanging messages between layers (Cosmos IBC).

The evolution of blockchains has naturally led to modular design:

The first generation of networks (Bitcoin, Litecoin) laid the foundations of crypto economics and consensus.

The second generation (Ethereum, EOS) added programming capabilities via smart contracts.

The third generation optimizes blockchains through separation of functions and specialization of components.

The modular approach opens up new opportunities for developers of dApps:

Choosing the best infrastructure for specific tasks

Cross-chain composability

Scalability

Promising application niches:

Next-generation deFi protocols

Scalable NFTs and meta-universes

Applications for corporations and government agencies

Real Asset Tokenization

New consensus algorithms are emerging among modular solutions. Everyone is familiar with PoW and PoS (Proof-of-Work and Proof-of-Stake). For example, Berachain uses a new consensus algorithm PoL - Proof-of-Liquidity.

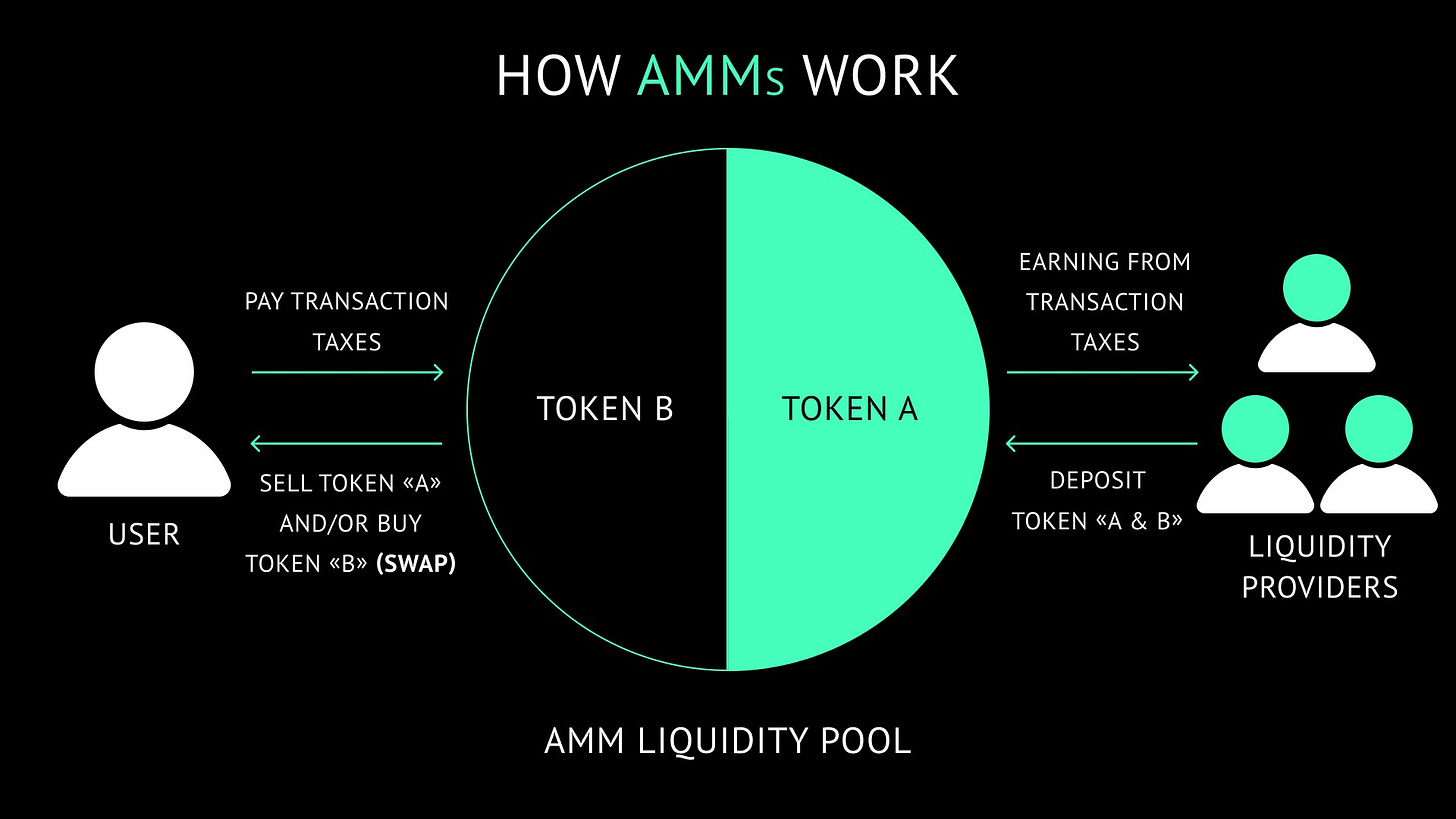

PoL differs from traditional PoS systems in that it requires users to contribute to the security of the network by providing liquidity for on-chain DeFi primitives such as AMM DEX, perpetual contracts, and stablecoin lending platforms.

We talked to the founder of Infrared (one of the leading protocols on Berachain):

What are the key advantages of PoL relative to other consensus algorithms?

“POL is more of an economic model, its automated grants to applications that enchance chains liquidity and economic acitvity. This is great since it removes the need for governance/politics which can make grant systems very slow and tedious.”

We also prepared questions for Yogi, Head of Ecosystem at Berachain. Here's what the head of the project's ecosystem told us.

As far as we know Berachain grew out of the NFT collection released in 2021. Was this planned in advance: an NFT launch at the peak of the bull market, followed by an own blockchain, or is the team adapting to current market realities?

“Berachain first grew out of the Bong Bear NFT collection which was created during the NFT cycle just for fun. It was the first NFT rebasing project and the community that formed was a combination of both left and right curve. We saw how much power and potential there was in this and from that community Berachain was formed.”

It is especially important to note the way Berachain builds its interaction with the community:

“More than anything Berachain is it's community. Most blockchains/protocols start by creating a product, then try to get PMF, and then build a community. We took a different approach. We started with a powerful community, saw a major problem that has continued to plague blockchains and its users and came up with an idea that puts our users and ecosystem first. Our cult-like following is the result of having an aligned vision, a new and unique solution to a problem which has historically made its users secondary, and starting with a deeply committed and passionate community.”

The modular approach has a huge potential for development:

Next-generation DeFi protocols will be able to take advantage of the separation of consensus and execution layers, opening the way to cross-chain composability. It will be possible to create a single borderless capital market where any token is used as collateral in any application. Atomic transactions between specialized blockchains will help solve the problem of fragmented liquidity.

For NFTs and metavillages, modular runtime environments (zkEVM, Cosmos SDK, etc.) will allow each game to deploy a blockchain customized for its mechanics and tokenomics. At the same time, basic NFTs (items, skins, lands) will be able to be transferred between worlds without loss of ownership. No more reinventing the wheel - the basic modules (consensus, database) will already be available out of the box.

Businesses need blockchains that provide privacy, regulatory compliance, and the ability to transact in fiat. Modular architecture is ideal for customizing such networks. For example, you can deploy closed consensus between trusted nodes, isolate confidential smart contracts in special secure environments, while maintaining connectivity to the public layer for external auditing.

Effective tokenization of real assets requires specialized platforms with underwriting, AML verification, and secondary trading functions. With modular design, such platforms can be quickly customized to meet the needs of issuers and investors. One underlying blockchain takes the role of a global ownership registry, while others implement regulatory requirements for specific asset classes.

Risks and challenges of modularization

However, behind every modularization opportunity, there are new risks to be aware of:

Compiling heterogeneous modules expands the attack surface. A vulnerability in the zkSNARKs library or a bug in the consensus can compromise dApps on multiple L2s at once. Providing a consistent security model in such an environment is a non-trivial task.

It is unclear how to synchronize forks and upgrades between independent layers. If the consensus chain is updated more frequently than the runtime environments - there is a risk of loss of finalization or replay attacks. We need formal specifications and common standards for protocol evolution.

By entrusting execution and storage to third-party services, developers lose some sovereignty and control over the security of user facilities. Not all applications are willing to make this compromise. There is a need for intermediate solutions that combine customization and attestation by the underlying blockchain.

Finally, we cannot forget about the human factor. Even a perfect protocol is useless without an active community of developers, auditors, and infrastructure providers. In order for the modular ecosystem to grow, we need to increase the number of specialists who understand the intricacies of cryptography and distributed systems design.

The first steps in this direction are already being taken. Educational programs and courses are launched, hackathons and competitions are held. A vivid example is the Cosmos initiative to create the Interchain Foundation, which allocates grants for research in the field of cross-chain communications and security.

Conclusion

The move to a modular architecture is already, in fact, accomplished. It promises to be the missing link to the vision of web3 - a global ecosystem of interoperable, community-driven services. Developers will be able to combine off-the-shelf modules to create next-level applications. And users will have powerful tools to launch their own economies - from registering assets to conducting complex financial transactions.

2.7 Social-FI

When was the last time you stopped to think about how technology has changed the world around you? From the pocket computer to artificial intelligence that predicts your next move.

Chronology

It would seem that Web1.0 is the most primitive and simple, but at the same time it’s the real and warm Web1.0. The first World Wide Web covered the span from about 1991 to 2004. Access to the Narnia of freedom was not open to everyone, the number of web1 users in the world was estimated at about 45 million.

With the beginning of the Web2 era and the increasing availability of broadband Internet, social networks began developing rapidly.

Now social networks have become powerful platforms with billions of users around the world. They have become tools for news, business, politics, and social activism, and we the users have become a tool for the parent companies of these social networks.

After Web1 laid the foundations for digital interaction, and Web2 transformed the Internet into a dynamic space for social interaction and collaboration, we are on the cusp of a new revolution - Web3.

This new phase represents an entry into the era of decentralized technologies, where social finance (Social-Fi) promises to return control of data and value directly to users. But what will be the paths and obstacles of this journey into the uncharted depths of Web3, and what is Social-Fi's role in the transformation to come?

Social-Fi brings together social media and decentralized financial instruments (DeFi), allowing users to not only interact on social networks, but also conduct financial transactions, invest and earn money from their content in a decentralized environment.

As we can see in the graph, interest in the field of decentralized social networks emerged at the end of 2021. But the peak of interest in the topic came at the junction of 2023-2024.

Key projects

Friend.Tech is a decentralized social app based on Coinbase's L2 solution Base, integrated with the X social network.

How much money and influence is in that one phrase? And if you add Paradigm to it?

You get a picture like this:

In the first days of the application recorded 136k unique users, it should be noted that the protocol is closed and you can get there only by invites of already logged in users.

At the moment the number of unique users of the protocol is over 1 million users. But here we should not forget about the forest sanitarians in the form of drop hunters. It is they who created this frenzied activity in the protocol, which occurred in September 2023.

Based on the graph we can see that the activity since November 2023 has sharply decreased. We can conclude that the statistics are inflated through wallets and in reality the number of unique addresses is much less.